- 90.2LEGITIMACY SCORE

- 90.7SAFETY SCORE

- 4+CONTENT RATING

- FreePRICE

What is Albert: Budgeting and Banking? Description of Albert: Budgeting and Banking 3519 chars

THE SIMPLE WAY TO BUDGET, BANK, SAVE, AND INVEST

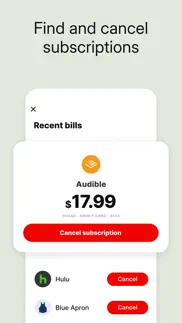

Save and spend smarter when you manage your money with Albert. Manage your budget and spending across multiple accounts, track subscriptions, get smart alerts to save more and spend less, save and invest automatically, get up to $250 in overdraft coverage, monitor your identity and credit score, and finance experts.

Albert is not a bank. See disclosures below.

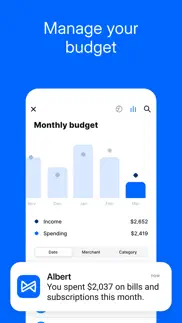

KNOW WHERE YOUR MONEY’S GOING

• Manage your monthly budget

• Personalized spending insights

• Track bills and subscriptions

• See all your accounts in one place

BANKING WITH GENIUS

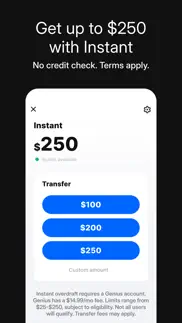

• Overdraft up to $250

• Get paid up to 2 days early with direct deposit

• Earn cash back rewards

SAVE SMARTER

• Automatic saving

• Create and track goals

• Earn cash bonuses

GUIDED INVESTING

• Invest automatically

• Buy stocks and ETFs

• Managed portfolios

PROTECT YOUR MONEY

• Identity protection

• Credit score monitoring

• Real-time alerts

DISCLOSURES

Banking services provided by Sutton Bank, Member FDIC. Savings with Genius and Albert Savings accounts (together, “Savings”) are held for your benefit at Coastal Community Bank, and Wells Fargo, N.A., Members FDIC, respectively (together with Sutton Bank, the “Deposit Banks”). The Albert Mastercard® debit card is issued by Sutton Bank, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Funds in Albert Cash and Savings are held in pooled accounts at their respective Deposit Banks and each are FDIC-insured up to $250,000 on a pass-through basis. Your FDIC insurance for each such account is subject to Albert maintaining accurate records, a positive determination by the FDIC as receiver if a Deposit Bank should fail, and with respect to each Deposit Bank the aggregation of all of your deposits held at that Deposit Bank. Albert Investing accounts are not FDIC insured or bank guaranteed and involve the risk of loss.

The Albert Subscription costs up to $14.99 per month. Try it for 30 days before you're charged. The Albert Subscription fee will auto-renew until canceled or your Albert account is closed. Cancel any time in the app. The Albert Subscription does not include all Albert features. See Terms for more details.

Genius, which includes Albert Cash, Savings with Genius, and all features offered by the Albert Subscription, has a maintenance fee that costs $14.99/month when billed monthly, or $149.88 annually if available. You’ll be charged 30 days after signing up. Deactivate Genius or close your Albert account any time in the app.

With Instant overdraft coverage eligible members can overdraw their Albert Cash account for debit card purchases, ATM withdrawals, and transfers. Limits start at $25, are reevaluated on an ongoing basis, and are subject to eligibility requirements based on your linked bank account activity, and other factors. Fast transfer, ATM and other fees may apply.

Brokerage services provided by Albert Securities, member FINRA/SIPC. Investment advisory services provided by Albert Investments. Investing accounts are not FDIC insured or bank guaranteed. Investing involves the risk of loss. More info at albrt.co/disclosures.

Credit score calculated on the VantageScore 3.0 model. Your VantageScore 3.0 from Experian® indicates your credit risk level and is not used by all lenders, so don't be surprised if your lender uses a score that's different from your VantageScore 3.0.

- Albert: Budgeting and Banking App User Reviews

- Albert: Budgeting and Banking Pros

- Albert: Budgeting and Banking Cons

- Is Albert: Budgeting and Banking legit?

- Should I download Albert: Budgeting and Banking?

- Albert: Budgeting and Banking Screenshots

- Product details of Albert: Budgeting and Banking

Albert: Budgeting and Banking App User Reviews

What do you think about Albert: Budgeting and Banking app? Ask the appsupports.co community a question about Albert: Budgeting and Banking!

Please wait! Facebook Albert: Budgeting and Banking app comments loading...

Albert: Budgeting and Banking Pros

✓ 🥺😭😭 What rainy day fund? 😢😢😡Do NOT use this app! I do not write reviews often but I had to report this one. I opened my account in July of 2021 and I forgot all about it. I started to do instacart in Jan of 2022 to try and make a few extra dollars and I had my money deposited into this account for a rainy day fund. I never used the app or the card to check my balance or spend money because I wanted it to be a true savings account. I was excited because I knew the money was adding up in my account. I checked Albert this morning thinking I would see almost $200 or more in my account and I only have $98!! I check the statements and there is a $7 charge each month (16 months) for benefits I never used or signed up for. I explained my situation to the computer because you can’t speak to anyone on the phone and they said I don’t qualify for a refund because it is past the 30 day trial subscription. I didn’t make my 1st deposit until 6 months after I opened the account and that is when the charges kicked in. How was I to know I was on a subscription if I was never charged for it before I started making deposits? They are a scam and will take your money don’t do it!.Version: 8.3.16

✓ Amazing appI was always too lazy to go to the bank or an ATM to withdraw cash to save for various things (vacations, emergencies, Christmas), and I didn’t want to create an actual savings account that would lump it all together, so I constantly had NO money saved because I didn’t have the discipline to not spend all that I had in checking. Albert is AMAZING! It lets me create as many folders as I want, for whatever I want. They have “smart savings,” where they automatically will save a certain amount of money for you each week and spread it across your folders, based on the priority you’ve given them. Then, you can also add funds as you’d like. Best of all, you can withdraw money whenever you need, without any fees. It does take a couple of days to post to your bank account, but that is the ONE, single thing about the app that I don’t love, and I can completely understand why it can’t be immediate. Love love love this app. I talk about “my Albert” to friends and family at least a couple times each week, and they know exactly what I’m talking about. And you can choose how much to pay for the monthly subscription, so if you’re super tight on money like I was when I first got the app, you can give just $5/month and have all of these great benefits..Version: 5.3.3

✓ Albert: Budgeting and Banking Positive ReviewsAlbert: Budgeting and Banking Cons

✗ Worst of these appsUpdate: SCAM ALERT!!! I now think this is effectively a scam. I finally broke out of the cycle of needing the advance and having to repay on pay and I can’t even cancel my subscription. When I do the normal cancel process it says I can’t cancel because I have transactions processing despite the fact I haven’t used any of the savings or instant features in weeks and no longer have money in my account. Contacting support through the help number is no use - it just told me to do the normal process I already tried (that doesn’t work) and stopped responding to me when I said I had tried that and asked to be connected to a human. Looks like I will be contacting Bank of America to revoke their access to my account and the FTC will also be getting a compliant about them from me. STAY AWAY!!!! Original review: 1st warning sign is these rich fintech bros have the gall to ask you for monetary tips on their incredibly sub-par app. Does not seem to comprehend pay schedules out side of bi-weekly and 15th and last day of the month. I get paid on the 7th and 22nd of every month but this app is too stupid to pick on the pattern and frequently expects payback on the 6th despite the fact that has never been my payday!!!! It then gets mad and needs to reverify my income before doing another advance.Version: 8.3.27

✗ No more budgeting :(I’ve been a customer for the past 4 years. I really loved how simple and straightforward this app was. Over the years, there have been new features added but the core features remained. Recently, budgeting was taken away. The main reason I downloaded this app initially was to help with budgeting. I loved how simple the system was. Income - (bills + spending) = remaining money for the month. It was a quick and easy way to track my spending and make sure I was staying within my budget each month. Now that this feature is gone, I’m planning on canceling my subscription and transferring all of my investments and savings into another account. Long gone are the days of an easy to use, simple budgeting app. I’m sad to leave, but I can’t justify paying for any services that Albert provides anymore without this feature. As an aside, the app overall is fine. It does crash from time to time when trying to update the notification cards on the home page. Sometimes it crashes randomly. The team should probably try and fix those. Genius has gotten a lot slower since the early days and the app has become more cluttered with information I don’t care about. The genius tab on the tab bar is my least favorite feature that the team added..Version: 7.4.24

✗ Albert: Budgeting and Banking Negative ReviewsIs Albert: Budgeting and Banking legit?

✅ Yes. Albert: Budgeting and Banking is 100% legit to us. This conclusion was arrived at by running over 170,910 Albert: Budgeting and Banking user reviews through our NLP machine learning process to determine if users believe the app is legitimate or not. Based on this, AppSupports Legitimacy Score for Albert: Budgeting and Banking is 90.2/100.

Is Albert: Budgeting and Banking safe?

✅ Yes. Albert: Budgeting and Banking is quiet safe to use. This is based on our NLP analysis of over 170,910 user reviews sourced from the IOS appstore and the appstore cumulative rating of 4.5/5. AppSupports Safety Score for Albert: Budgeting and Banking is 90.7/100.

Should I download Albert: Budgeting and Banking?

✅ There have been no security reports that makes Albert: Budgeting and Banking a dangerous app to use on your smartphone right now.

Albert: Budgeting and Banking Screenshots

Product details of Albert: Budgeting and Banking

- App Name:

- Albert: Budgeting and Banking

- App Version:

- 8.3.50

- Developer:

- Albert Corporation

- Legitimacy Score:

- 90.2/100

- Safety Score:

- 90.7/100

- Content Rating:

- 4+ Contains no objectionable material!

- Category:

- Finance

- Language:

- EN

- App Size:

- 194.97 MB

- Price:

- Free

- Bundle Id:

- com.albert.Albert

- Relase Date:

- 02 June 2016, Thursday

- Last Update:

- 18 March 2024, Monday - 16:57

- Compatibility:

- IOS 14.0 or later

We've refreshed the look of our app and updated the Genius tab to make it even easier to get advice from our team of finance experts. Plus, we've pushed a handful of fresh tweaks to enhance your experience. Enjoy!.